In Part 1, on basic principles, I suggest that it is better to impose taxes on existing wealth rather than the wealth-creation process, and also that in general direct taxes are more honest than indirect taxes (often described as stealth taxes). This item brings these strands together under the question of which taxes might be eliminated, reduced or maintained within a system where LVT plays a significant part.

Prior to the 20th century, taxes in Britain were few in number: In the 1870s customs and excise duties still accounted for 60% of government revenue, income tax about 8%. Governments had always raised money through borrowing from private individuals or banks in order to fund wars (so establishing the National Debt). The introduction of the income tax in 1799 was intended as a temporary measure to fund the Napoleonic wars. Everyone was against it, and for the best part of the 19th century politicians on both sides made many promises to abolish it. But the income tax was difficult to shake off, as we all know. There was, of course, no welfare state as we know it today. Poor relief was obtained through the old poor-law acts of 1601, which were financed through local taxes at parish level. ––the ‘rates’.

The proliferation of the many different forms of taxation we know today occurred mainly in the 20th century due to the advent of the welfare state, and the need to finance the growing demand for social services. These taxes are now both numerous and complex and the contemporary tax regime does not seem to readily conform with any of Adam Smith’s four maxims, let alone that of certainty. It is difficult now for most ordinary taxpayers to grasp the convoluted workings of the income-tax system without resort to expert advice or guesswork. There is undoubtedly a need for simplification, if only to provide people with a clear understanding of what taxes they are expected to pay.

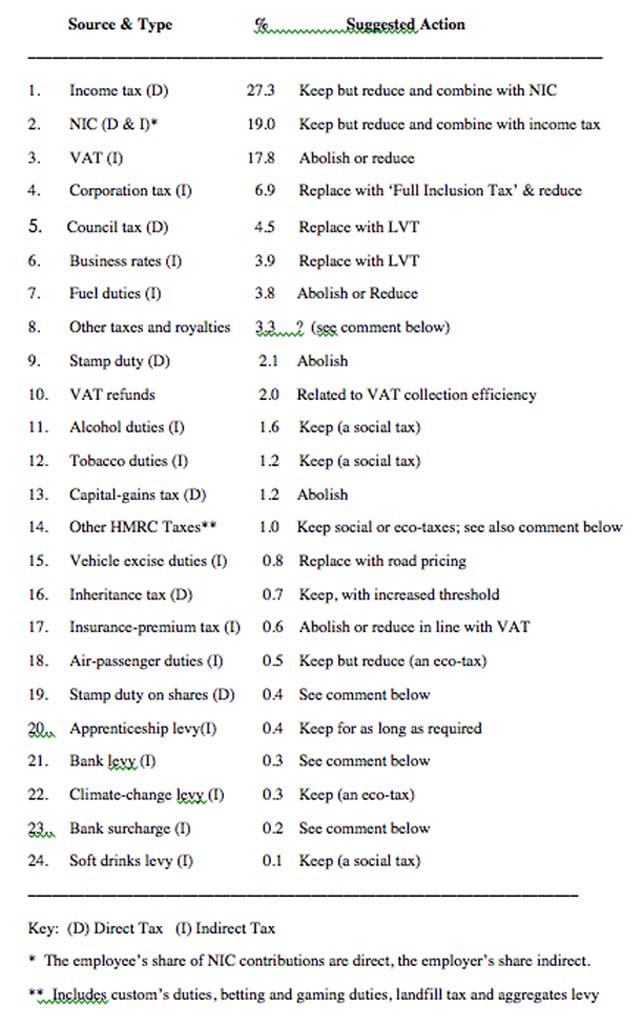

In 2008 the Office for Budget Responsibility (OBR) published its ‘Sources of Government Revenue’ forecast for 2008–09, which showed up to 20 different sources. In July 2010 HM Treasury established The Office of Tax Simplification (OTS) for the purpose of reducing the complexities of the tax system for both business and individuals. In 2019 OBR published its forecast for 2019–20 which showed an increase to 24 sources (see Table 4). So it isn’t clear to me what the OTS had achieved in that 11-year period.

So what should be done?

I believe that the introduction of LVT would provide a clear and unambiguous source of revenue that could be used to enable the reduction or elimination of other undesirable taxes––but which taxes?

Table 4, taken from the Office for Budget Responsibility data, shows the forecast for 2019–20 for government tax receipts from all sources. There are a total of 24, which are listed in descending order of the percentage of revenue raised. Income tax tops the list followed by national insurance and VAT. These three account for 64% of all revenue, far more than the other 21 sources combined, so clearly they are very significant.

Table 4. UK Government Tax Receipts for 2019–20 (source: Office for Budget Responsibility, Economic and Fiscal outlook for 2019–20)

In the table, the column headed ‘suggested action’ represents my proposals as to which taxes might be abolished, replaced or kept. This I found surprisingly difficult to decide. Although I tried to be objective, I daresay my own view is no better or worse than anyone else’s. Perhaps you might like to compile your own list of preferences? In addition to the suggestions I have made, here are some further comments about some of the taxes:

Income Tax and NIC If only to simplify administration, there is a good argument for combining income tax and NIC into one tax, which could be much reduced, and with a higher entry threshold.

VAT VAT is a Europe-wide tax. Now that Britain has left the European Union it could be reduced or abolished altogether. Britain adopted VAT on joining the EU; it replaced the old purchase tax. In Australia VAT is known as GST, a goods and services tax, applied at a rate of 10%, considerably less than the rate of VAT in Europe. There is no VAT in the USA, but a sales tax on goods and services (the inverse of a purchase tax) applied at state and, often, local levels.

Corporation Tax Corporation tax is very vulnerable to avoidance and is a problem in all countries. It is a tax on manufactures and trade and ideally should be abolished or reduced, but it needs to be agreed internationally to avoid retaliation from other countries competing for business investment. An interesting article on the Schumpeter blog of the Economist, dated 15 March 2013, describes two possible alternatives to the Corporation Tax: the ‘Unitary Tax’ and the ‘Full Inclusion Tax’. The latter would appear to have several advantages and should be seriously considered as a replacement.1

Council Tax and Business Rates Council tax and business rates are property taxes and ideal candidates for replacement by a local site value tax (see Part 2, Application of LVT)

Fuel Duties Fuel duties should be abolished or reduced, as they are a tax on transport that affects everyone adversely. But they are also seen as a deterrent to carbon emissions––so a balance has to be found. Perhaps they could be absorbed into a system of road pricing.

Other Taxes and Royalties In the OBR data these are noted as: licence fee receipts, environmental levies, EU ETS auction receipts, Scottish taxes, diverted profits tax and other taxes. Under suggested action I have perhaps unsurprisingly left a question mark. They are not necessarily all taxes, but other sources of revenue, but they account for a substantial 3.3% of all receipts.

Stamp Duty Stamp duty (officially, but rather misleadingly known as Stamp Duty Land Tax, for historic reasons) is a tax on trade and increases the cost of housing. It should be abolished.

Capital gains Tax Capital Gains Tax should be abolished. One of the main purposes of this tax is to recoup the (unearned) increase in value of properties on resale, but this could be done more effectively through a land-value tax.

Other HMRC Taxes The social and eco-taxes could be kept. Customs duties are subject to international negotiation; they are a free/fair trade issue.

Stamp Duty on Shares Stamp duty on shares could be included in a general reform of financial transactions to combat unproductive speculation in currencies and shares, short selling and other predatory practices. It is a complex area, which would require international co-operation and is beyond the scope of this book, but it exercises an increasing number of reformist organisations, which seek to bring under control the ‘wild west’ world of finance, in which taxes play a large part.

Bank Levy and Bank Surcharge The Bank levy was imposed after the economic collapse of 2007–8, as a sort of repayment for the bank bailouts. For that reason most people would think it justifiable. The Bank Surcharge was introduced in 2016 as an extra tax on bank profits, but only brings in 0.1% of total revenue. There would seem to be a need for some rationalisation of corporation tax, bank levy and bank surcharge in the question of how to tax banking activity.

Inheritance tax Finally I would single out inheritance tax as a rather special case. It is true that it does not rank highly on the list of revenue earners, but it raises strong feelings for and against. Those who are opposed say it should be abolished altogether; why after all should those who have worked hard all their lives not be allowed to leave what wealth they have to their children?––A good point with which I have much sympathy. However there has always been a strong counter argument where large amounts of wealth are inherited: Why should some be allowed to inherit a fortune, which could enable them to live well the rest of their lives without ever having to do a stroke of work? The current system, with a threshold of £325 K, is a compromise, but is probably insufficiently generous. This threshold could be raised to £500 K or even £1m, which would seem a decent amount for anyone to inherit. These figures are always a matter of debate, and in any case should always be subject to revision, due to normal inflation.

I suggest that whatever loss of revenue may be incurred from eliminating or reducing any of the above taxes could be made good from a new land value tax. In all cases, gains and losses have to be graduated over a transition period, and the principle of tax neutrality respected.

Those hard-line Georgists who still insist on the single tax would presumably eliminate all 24 taxes––a difficult proposition to imagine. One suspects they might be willing to compromise on some of them.

References:

(1) Refer to: https://www.economist.com/schumpeter/2013/03/15/a-modest-proposal